A Versatile Investment Option

Did you know there is a way to earn tax-free investment income? There are no restrictions on how TFSA funds can be used, making them good savings options for retirement and other reasons (e.g. purchase a car, renovate a home, start a small business, take a family vacation, or just emergency savings). All income levels can benefit from a TFSA.

TFSA Eligibility

Any individual (not trusts or corporations) who meets the following criteria is eligible to open a TFSA:

- Resident of Canada

- 18* years of age or older

- Holds a valid social insurance number (SIN)

There is no maximum age limit to open or hold a TFSA and a person may hold more than one TFSA.

*In New Brunswick, Nova Scotia, Newfoundland, British Columbia, the NWT, Yukon, and Nunavut, the holder must be 19 years of age or older.

Opening a TFSA

You can have a TFSA in a variety of holdings, such as a savings account, a term deposit, or a mutual fund investment. Contact LCU or LCU Financial to register your holdings as a TFSA with the Canada Revenue Agency. We will need your SIN and date of birth.

TFSA Contribution Limit

Contributions to your TFSA are not tax deductible, and may not only be made by you, the Holder. The amount you can contribute each year is set by the government. The annual contribution limit for 2022 is $6,000. The TFSA program was launched in 2009, the total contribution limit as of 2022 is $81,500.

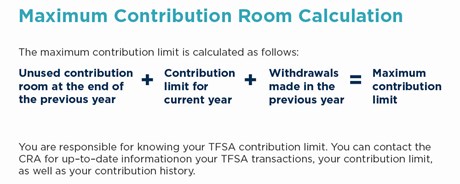

Unused TFSA Contribution Room

When you contribute less than the maximum contribution limit, the difference is referred to as ‘unused contribution room’. Unused contribution room accumulates each year and is carried forward indefinitely, allowing you to ‘catch up’ in future years.

Qualified Investments

The types of investments eligible for TFSAs are restricted under the Income Tax Act. Options available through LCU and LCU Financial include:

- Term deposits

- Savings Accounts

- Mutual funds

Withdrawals

One of the great advantages of TFSA accounts is that you can withdraw funds at any time (may be subject to investment terms). Withdrawals are not subject to income tax, and do not impact eligibility for federal income tested benefits and credits (e.g. OAS, GIS, Age Credit, GST, EI, child tax benefit, working income tax benefit).

Withdrawals from TFSA accounts will increase your contribution room in the following year, but not for the year of withdrawal.

Excess TFSA Contributions

It is important to keep track of your contribution room. If you contribute more than allowed to your TFSA, you will be penalized by the Canada Revenue Agency. An excess contribution will result in a 1% per month penalty tax on the highest excess amount in each month. The tax applies until the entire excess amount is withdrawn or absorbed by new contribution room in subsequent years.

The CRA will advise you when an excess contribution occurs.

Transfers

TFSA funds are transferable through:

- In between financial institutions

- Your spouse/common-law partner (CLP) on your death.

- A former spouse/CLP, on relationship breakdown

Borrowing Money to invest in a TFSA

With today’s historically low lending rates, some investors are borrowing funds to invest in their TFSAs. Interest on money borrowed to purchase a TFSA is not tax deductible. Contact us to learn more and to find out if this option could work for you.

*Information provided by the Canadian Credit Union Association © 2016